Understanding Scotland Economy Tracker - August 2025

Read insights from the August 2025 Understanding Scotland Economy Tracker, how is the economy affecting people’s lives in Scotland?

Published 26th August 2025

Economic pressures continue to weigh heavily on households across Scotland, with new data from the Understanding Scotland Economy Tracker revealing widespread cost-cutting and continued anxiety about the future.

The survey commissioned by the David Hume Institute and the Diffley Partnership, regularly tracks public opinion and spending intentions, collected data in the first week of August.

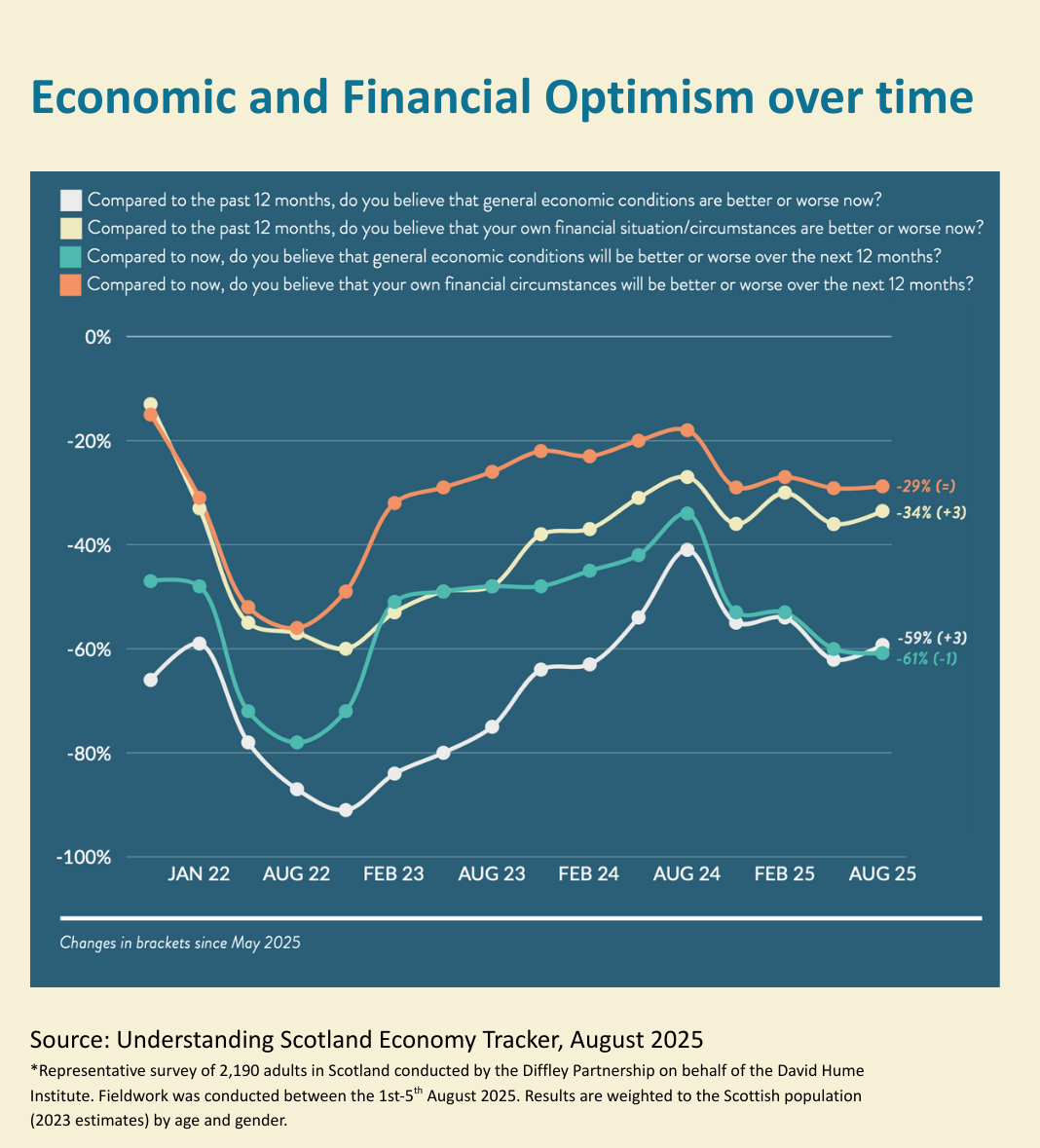

Economic Outlook and Optimism

Almost three in four (71%) Scots expect the general economy to worsen over the next year.

Two out of three (67%) report that general economic conditions have worsened over the last twelve months (down from 70% in May 2025).

When Scots think about their own financial circumstances, they are spilt by only 3% - 46% believe conditions have worsened, while over 43% believe conditions are about the same, up 3% over the last quarter. Another 10% of Scots feel their finances are somewhat better than last year.

Priorities and Concerns Summarised in graphs

Understanding Scotland Economy Tracker - May 2025

Read insights from the May 2025 Understanding Scotland Economy Tracker, what do people think about the economy and how is affecting their life in Scotland?

Published 27th May 2025

Economic Outlook

The latest Understanding Scotland Economy Tracker highlights the precarious financial position of many Scots. Significant numbers of people are just one unexpected bill away from crisis.

1 in 5 Scots cannot cover an emergency expense of £100 without borrowing money

This figure doubles to 44% for a £500 emergency, demonstrating a widespread lack of financial resilience.

Overall there is an increase in people believing that both general economic conditions and their own financial circumstances will get worse in the coming 12 months.

Top priorities and issues

The latest survey found that healthcare and the cost of living remain as the most pressing issues, cited by one in two and one in three respectively. The next most cited issue is poverty (17%).

However, for the first time since the tracker began in October 2021, immigration has joined the top five public concerns. Immigration is now ranked as a top issue by 16% of Scots - up six percentage points since May 2024 and is now equal with the economy.

The top five priorities listed by survey respondents are:

Healthcare 49%

Cost of living 36%

Poverty 17%

Immigration 16%

Economy 16%

More insights from the research

Understanding Scotland Economy Tracker - February 2025

Our latest independent economic tracker reveals the economy is emerging as a key priority as 62% of Scots say conditions have worsened in past year.

Published Monday 24th February 2025

Our latest independent quarterly tracker has revealed the economy is emerging as a key priority as 62% of Scots say conditions have worsened in past year.

Key findings:

Health care and the cost of living remain top priorities, with the economy emerging as a high priority for Scots

Healthcare continues to dominate as the most pressing issue for Scots, increasing by four percentage points to 50% naming it as a priority. Cost of living remains stable at 34%. Meanwhile, the proportion identifying the economy as a priority has risen by four percentage points to 20% after hitting a low of 16% in November 2024.

Glimmers of optimism as more Scots see the country heading in the right direction

While 53% of Scots still believe the country is heading in the wrong direction, this is down three percentage points from the last wave. At the same time, optimism is growing, with 24% now saying Scotland is on the right path - an increase of four percentage points. Meanwhile, 23% remain uncertain, with optimism narrowly overtaking uncertainty for the first time in recent waves.

Economic outlook remains bleak

A majority of Scots (62%) say economic conditions have worsened over the past year, and 64% believe they will deteriorate further in the next year. While this marks a slight decline of one to two percentage points in pessimism since the last wave, optimism has not grown, with fewer than one in ten reporting an improvement in the last year or predicting an improvement over the next year.

Cost-cutting becomes routine but financial strain hits some harder

Spending cutbacks remain widespread, with 53% of Scots reducing leisure activities, 52% cutting non- essential spending, and 45% saving less than usual—figures that have changed little since November 2024. However, financial strain is more pronounced among Scots aged 16-34, those in lower social grades, households with children, and ethnic minorities, particularly affecting their mental health, physical well-being, and sleep.

Signs of recovery for some sectors but non-essential spending cuts persist

Spending reductions are expected to continue this year, particularly in dining out, with 45% cutting back on takeaways and deliveries and 43% on restaurants. However, there are small signs of recovery in certain areas: the proportion expecting to spend more on clothing and footwear is up five percentage points, while leisure and culture and holidays outside the UK have seen increases of three percentage points each.

Three key graphs from the report below.

Image credit: Sharing thumbnail image and report front cover by Sinitta Leunen, free licence from Unsplash 23.02.25

Understanding Scotland Economy Tracker - November 2024

Our quarterly economic tracker from a panel of over 40,000 people in Scotland reveals green shoots of optimism in August have faded and poses big questions ahead of the Scottish Budget.

Our independent quarterly tracker has revealed that 48% of people living in Scotland believe their financial situation is worse than a year ago.

Since August 2024, there has been a six percentage point rise in people feeling that their own finances have worsened in the last year – with 3 in 10 people (29%) admitting they have lost sleep over money.

While 63% believe that the general economic conditions are worse, up nine percentage points, 65% of people said they believe that the general economic conditions will continue to decline, up 13 points on the last quarter.

The latest results for the Understanding Scotland Economy Tracker, from the David Hume Institute and polling experts Diffley Partnership, suggest a growing lack of optimism over the last three months and pose big questions for Shona Robison ahead of the Scottish Budget.

The latest edition of the survey from November 2024 shows that:

More than 1 in 6 people (17%) report strained relationships at home because of money

1 in 6 Scots (16%) report an impact on their physical health due to worries about money

1 in 3 people (32%) report an impact on their mental health due to worries about money

Only 15% say that concerns about money matters have not affected them

3 out of 4 people (75%) believe the economy works primarily in the interests of wealthy people

However, there is not a complete lack of optimism with younger Scots more likely to believe that their financial fortunes will turn. Those aged between 16 and 34 appear more optimistic with 25% saying they believe their own economic situation will get better. This compares to just 6% of 45 to 54 year-olds, 8% aged 55 to 64, and 5% of over 65s.

When looking at the policy priorities for Scots, healthcare and the NHS remains the top priority of Scots with nearly half (47%) citing this as one of the top three issues facing Scotland. A third (34%) cite cost of living and inflation, this has declined eight percentage points from November 2023. One in five (19%) put poverty/inequality among the top three issues facing Scotland.

Understanding Scotland Economy Tracker - August 2024

Our quarterly economic tracker from a panel of over 40,000 people in Scotland reveals green shoots of optimism appearing

29th August 2024

Our independent quarterly tracker has revealed that one in three (36%) people living in Scotland consider the cost of living as one of their top concerns, down 12% on this time last year.

According to the Understanding Scotland Economy Tracker from the David Hume Institute and polling experts the Diffley Partnership, while concern about the cost of living has fallen, healthcare remains the key concern for the public, selected by over half (51%) of respondents as a key worry.

The data was collected at the start of August, a month after the General Election, against a backdrop of economic insecurity, mounting concern about public expenditure and a wave of anti-migrant riots.In our first survey since the General Election, data reveals some green shoots of optimism.

Over half (54%) of people in Scotland believe that general economic conditions are worse now than a year ago - a considerable fall from the 2 in 3 (66%) that agreed with this statement in May.

1 in 3 (35%) of those that express an opinion believe that general economic conditions are about the same as they were in August of last year, an increase of 11%.

15% of households with children say they feel better off than a year ago, compared to 10% reporting the same in August 2023 and 9% in August 2022.

Read more:

Press Release - Green shoots of optimism as fewer Scots concerned by cost of living

David Gow's Blog - Are we singing a new song?

Watch the event recording here.

The Great Risk Transfer: employment and financial wellbeing

New research investigating the Great Risk Transfer and the changed relationship between employers and employees. What are the implications for financial wellbeing?

20th August 2024

This research examines the impact of the Great Risk Transfer on individuals and society through the changing relationship between employer and employees.

What are the implications on productivity and aspirations for economic growth?

The report shows that a third of employers only provide the bare minimum when it comes to sick pay and pensions.

It also highlights how staff in hospitality, retail and social care are the most financially vulnerable and that over a quarter of Scots lose sleep over money worries.

The research finds:

more than two-thirds of employers (70 per cent) are concerned over the impact of financial strain on their employees and their productivity, citing increased stress on managers and other staff (35 per cent) and a rise in absenteeism due to poor health (28 per cent)

But

a third of employers (33 per cent) in Scotland do not offer any enhanced benefits as part of their employee benefits package

more than half (56 per cent) do not currently include financial wellbeing in strategies to support employees.

The Great Risk Transfer report recommends the need to:

Recognise employers’ power to drive change. Employers should recognise the connection between financial wellbeing and productivity and how their actions might alleviate employee’s pressures

Increase understanding of Living Pensions: Government and employers should work together to increase understanding of the need for Living Pensions and that employees on auto-enrolment minimums are not currently likely to be saving enough to live well in retirement

Complete the Pension Provision Review. The review of pensions provision signalled by the Labour Party before the 2024 election should go ahead and include a specific focus on potential improvements and innovations in workplace pensions.

This is the second piece of research the David Hume Institute has produced in partnership with the Institute and Faculty of Actuaries about the Great Risk Transfer.

David Hume Institute commissioned the Diffley Partnership, to investigate employer attitudes to the Great Risk Transfer as part of this research. The survey was conducted in May and June 2024 and is based on responses from 550 businesses. The full survey results were published as an appendix to the main report.

Read more:

Press release - Bare minimum from many employers driving poor productivity.

Watch the event launch recording here.

Image credit: sharing thumbnail image by The Chaffins free from Unsplash on 07.08.2024

Understanding Scotland Economy Tracker - May 2024

Latest in the Understanding Scotland Economy Tracker series reveals a mixed picture of public opinion of the Economy.

The latest survey from the Understanding Scotland Economy Tracker series reveals that healthcare and the cost of living are at the forefront of Scottish voters' minds as they get ready to decide how to cast their votes in July.

Latest findings from the series show the top two issues for voters in Scotland are:

one in two Scots (52%) cite healthcare and the NHS

two in five (40%) the cost of living and inflation is a key issue.

A host of other issues remain important to Scots, including poverty/inequality, trust in politics, the economy, and housing, which are regularly selected as top issues facing Scotland by upwards of 15% or more of Scots. However, there are notable changes in prioritisation among these issues, with emphasis on trust in politics rising two percentage points to 18% and emphasis on the economy falling two percentage points to 17%.

The constitution and devolution is reported as a top issue by only 7% of Scots in the latest figures for May 2024.

Read more:

Press release: Health Care and Cost of Living Top Priorities for Scots ahead of General Election.

David Gow’s blog: Shaking off our misery?

Catriona Matheson’s blog: People’s priorities laid our for politicians.

Watch the event recording here.

Understanding Scotland Economy Tracker - February 2024

Our latest quarterly economy tracker reveals a continuing stark picture of public opinion on the economy.

Our survey shows two in three Scots (67%) have resorted to reducing non-essential purchases, while significant proportions continue measures such as cutting back on energy use (64%) and leisure activities (62%).

Additionally 45% report decreased savings contributions, and over a third are tapping into them for everyday expenses. These coping mechanisms are particularly prevalent among younger age groups, underscoring the disproportionate impact of the high cost of living on working-age individuals.

The Understanding Scotland Economy Tracker survey tracks economic attitudes and spending intentions from more than 2,000 members of the Scottish adult population every 3 months. The fast turnaround time, as the data is published two weeks after collection, means early identification of changes in trends to support decision-makers.

The study reveals a cautious outlook among Scots regarding future spending. Both essential and non-essential spending expectations show little change, indicating ongoing caution amidst economic uncertainty.

Furthermore, the latest findings highlight generational divides in priorities. Healthcare and the NHS are paramount among older age groups, whilst younger individuals are more focused on addressing rising living costs.

The study also reveals growing doubts among Scots about Scotland's trajectory, with the majority (58%) believing that the country is heading in the wrong direction. This marks a three-percentage-point increase from the previous wave and reflects an increasing sense of pessimism about the future.

Read more:

Press release - Two thirds of Scots continue to reduce spending.

David Gow’s blog - Scotland’s Generational divide - the economy.

Watch the launch event recording here.

Understanding Scotland Economy Tracker - November 2023

The Understanding Scotland Economy Tracker, marks its second birthday, showing many Scots continue to take extreme measures to navigate turbulent economic times.

The Understanding Scotland Economy Tracker, produced by the David Hume Institute and the Diffley Partnership, marks its second birthday, showing many Scots continue to take extreme measures to navigate turbulent economic times:

1 in 6 people (17%) report skipping meals

1 in 5 people are using ‘buy now pay later’ payment plans

2 out of 3 people (67%) are not putting the heating on to reduce costs

For many, the ongoing challenges with the cost of living are dominating their lives with:

3 in 10 (29%) Scots telling us they are losing sleep due to their personal finances

Many Scots are living with severe financial precarity:

3 in 10 people (28%) are not confident of covering a £100 emergency expense – up three percentage points since February 2023

This rises to 1 in 2 (49%) for an emergency expense of £500

The survey also shows 8 in 10 Scots perceive the economy as favouring the wealthy (78%), while 53% believe it primarily serves business interests. Only 1 in 10 (10%) believe that the economy works in their own interest.

Healthcare (48%) and cost of living (42%) remain among the top concerns for Scots.

Over three-fifths of Scots (62%) view the cost of living and inflation as a key economic priority, though this is down five percentage points from August. Poverty has become a significant concern for 32% of respondents, up three percentage points from August.

The Understanding Scotland Economy Tracker survey gathers economic attitudes and insights from more than 2,000 members of the Scottish adult population every 3 months to track changes over time.

Read more:

Press release - Two years of tracking shows Scots struggling with turbulent economic times.

Shan Saba’s blog - Avoiding the cost of living carnage.

Watch the event recording here.

The Scottish Home Report - why we need a review?

Professor Stewart Brymer makes the case for why a review of the Scottish Home Report is needed and how it will benefit the overall aim of delivering a better built environment in Scotland – which is itself integral to economic development

by Professor Stewart Brymer

Professor Stewart Brymer makes the case for why a review of the Scottish Home Report is needed and how it will benefit the overall aim of delivering a better built environment in Scotland – which is itself integral to economic development

Image credit: Photo by Kirsten Drew free from Unsplash on 20.08.2024

The Scottish Home Report consists of a single survey, an energy performance certificate and a property questionnaire – the latter being completed and signed by the selling home owner.

The single survey provides a comprehensive guide to the condition of the property, together with a valuation. In principle, therefore, it provides much more detailed information to both house buyers and sellers than is usually the case at present and avoids the need for competing house purchasers to commission separate surveys and valuations. It also ensures that there is an independent valuation of the property available so that potential buyers do not have to rely on the upset price or ‘offers over’ price to decide if it is likely to be affordable. In practice, there are variances in some locations on marketing techniques but in general, this has resulted in properties being marketed at or around 95% of the valuation in the single survey – the valuation being based on recent comparable evidence. The main point of negotiation with surveyors was the issue of liability. It was agreed that the surveyor’s duty of care would pass to the ultimate buyer.

Despite initial reservations, the Home Report has worked well in Scotland. However, it is not perfect. This paper discusses why a review is now required to support improvement.

About the Author

Professor Stewart Brymer graduated with First Class Honours in Law from the University of Dundee (1979). He is a past-convenor of the Property Law Committee of The Law Society of Scotland and co-Founder of the Scottish Conveyancers Forum.

Stewart is a member of the Professorial Panel on Property law matters and is an Honorary Professor at the University of Dundee.

He is also a prolific writer and is co-author of “Conveyancing in the Electronic Age” and “Leases” with Professor Robert Rennie and “Professor McDonald’s Conveyancing Manual” along with over 175 articles on Conveyancing and Leasing law.

Why is DHI thinking about the Home Report?

There is much discussion about the quality of the housing stock in Scotland. The need to retrofit ageing housing stock to cope with changing climate in the years ahead is a frequent subject of conversation. In our previous work on the Scottish Land and Building Information System (ScotLIS), the potential for improvement in the Home Report came up in discussion but we were not able to fully explore the issue. This discussion paper makes the case for why a review of the Home Report is needed and how it will benefit the overall aim of delivering a better built environment in Scotland – which is itself integral to economic development.